It is not possible to buy bitcoins at a bank or foreign exchange kiosks at this time. As of 2024, it is still quite difficult to acquire bitcoins in most countries. There are a number of specialized currency exchanges where you can buy and sell bitcoin in exchange for a local currency. These operate as web-based currency markets and include:

Bitcoin Exchanges

- Bitstamp (bitstamp.net): A European currency market that supports several currencies including euros (EUR) and US dollars (USD) via wire transfer.

- Coinbase (coinbase.com): A US-based bitcoin wallet and platform where merchants and consumers can transact in bitcoin. Coinbase makes it easy to buy and sell bitcoin, allowing users to connect to US checking accounts via the ACH system.

Crypto-currency exchanges such as these operate at the intersection of national currencies and crypto-currencies. As such, they are subject to national and international regulations and are often specific to a single country or economic area and specialize in the national currencies of that area.

Your choice of currency exchange will be specific to the national currency you use and limited to the exchanges that operate within the legal jurisdiction of your country. Similar to opening a bank account, it takes several days or weeks to set up the necessary accounts with the above services because they require various forms of identification to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) banking regulations. Once you have an account on a bitcoin exchange, you can then buy or sell bitcoins quickly just as you could with foreign currency with a brokerage account.

A more complete list can be found at http://bitcoincharts.com/markets/, a site that offers price quotes and other market data across many dozens of currency exchanges.

Other Methods to Acquire Bitcoins

There are three other methods for getting bitcoins as a new user:

- Find a friend who has bitcoins and buy some from them directly: Many bitcoin users started this way.

- Use a classified service like localbitcoins.com: Find a seller in your area to buy bitcoins for cash in an in-person transaction.

- Sell a product or service for bitcoin: If you’re a programmer, sell your programming skills. If you have an online store, see (to come) to sell in bitcoin.

- Use a bitcoin ATM in your city: A map of bitcoin ATMs can be found at http://www.coindesk.com/bitcoin-atm-map/.

How did people get the first Bitcoin?

Alice’s First Bitcoin Transaction

Alice was introduced to bitcoin by a friend and so she has an easy way of getting her first bitcoin while she waits for her account on a California currency market to be verified and activated.

Sending and Receiving Bitcoins

Alice has created her bitcoin wallet and she is now ready to receive funds. Her wallet application randomly generated a private key (described in more detail in “Private Keys” on page 63) together with its corresponding bitcoin address. At this point, her bitcoin address is not known to the bitcoin network or “registered” with any part of the bitcoin system. Her bitcoin address is simply a number that corresponds to a key that she can use to control access to the funds. There is no account or association between that address and an account. Until the moment this address is referenced as the recipient of value in a transaction posted on the bitcoin ledger (the blockchain), it is simply part of the vast number of possible addresses that are “valid” in bitcoin. Once it has been associated with a transaction, it becomes part of the known addresses in the network and Alice can check its balance on the public ledger.

Alice’s First Bitcoin Exchange

Alice meets her friend Joe, who introduced her to bitcoin, at a local restaurant so they can exchange some US dollars and put some bitcoins into her account. She has brought a printout of her address and the QR code as displayed in her bitcoin wallet. There is nothing sensitive, from a security perspective, about the bitcoin address. It can be posted anywhere without risking the security of her account.

Alice wants to convert just $10 US dollars into bitcoin, so as not to risk too much money on this new technology. She gives Joe a $10 bill and the printout of her address so that Joe can send her the equivalent amount of bitcoin.

Determining the Exchange Rate

Next, Joe has to figure out the exchange rate so that he can give the correct amount of bitcoin to Alice. There are hundreds of applications and websites that can provide the current market rate. Here are some of the most popular:

- bitcoincharts.com: A market data listing service that shows the market rate of bitcoin across many exchanges around the globe, denominated in different local currencies.

- bitcoinaverage.com: A site that provides a simple view of the volume-weighted average for each currency.

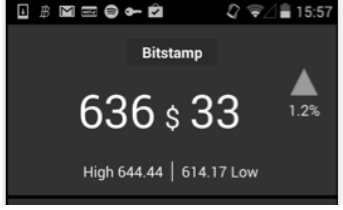

- ZeroBlock: A free Android and iOS application that can display a bitcoin price from different exchanges.

- bitcoinwisdom.com: Another market data listing service.

Using one of the applications or websites above, Joe determines the price of bitcoin to be approximately $100 US dollars per bitcoin. At that rate, he should give Alice 0.10 bitcoin, also known as 100 milliBits, in return for the $10 US dollars she gave him.

Sending Bitcoin

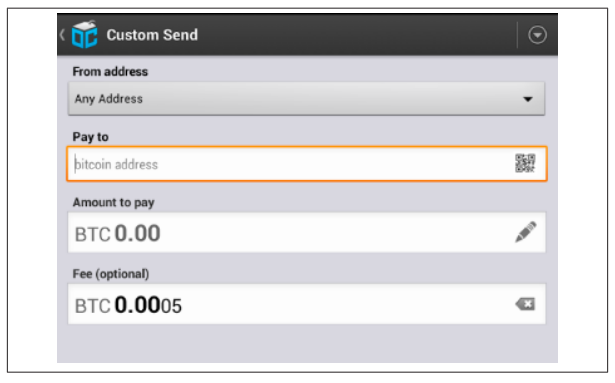

Once Joe has established a fair exchange price, he opens his mobile wallet application and selects to “send” bitcoin. He is presented with a screen requesting two inputs:

- The destination bitcoin address for the transaction.

- The amount of bitcoin to send.

In the input field for the bitcoin address, there is a small icon that looks like a QR code. This allows Joe to scan the barcode with his smartphone camera so that he doesn’t have to type in Alice’s bitcoin address (1Cdid9KFAaatwczBwBttQcwXYCpvK8h7FK), which is quite long and difficult to type. Joe taps on the QR code icon and activates the smartphone camera, scanning the QR code from Alice’s printed wallet that she brought with her. The mobile wallet application fills in the bitcoin address, and Joe can check that it scanned correctly by comparing a few digits from the address with the address printed by Alice.

Joe then enters the bitcoin value for the transaction, 0.10 bitcoin. He carefully checks to make sure he has entered the correct amount, as he is about to transmit money and any mistake could be costly. Finally, he presses “Send” to transmit the transaction. Joe’s mobile bitcoin wallet constructs a transaction that assigns 0.10 bitcoin to the address provided by Alice, sourcing the funds from Joe’s wallet and signing the transaction with Joe’s private keys. This tells the bitcoin network that Joe has authorized a transfer of value from one of his addresses to Alice’s new address. As the transaction is transmitted via the peer-to-peer protocol, it quickly propagates across the bitcoin network. In less than a second, most of the well-connected nodes in the network receive the transaction and see Alice’s address for the first time.

Verifying the Transaction

If Alice has a smartphone or laptop with her, she will also be able to see the transaction. The bitcoin ledger, a constantly growing file that records every bitcoin transaction that has ever occurred, is public, meaning that all she has to do is look up her own address and see if any funds have been sent to it. She can do this quite easily at the blockchain.info website by entering her address in the search box. The website will show her a page (https://blockchain.info/address/1Cdid9KFAaatwczBwBttQcwXYCpvK8h7FK) listing all the transactions to and from that address. If Alice is watching that page, it will update to show a new transaction transferring 0.10 bitcoin to her balance soon after Joe hits “Send”.

Conclusion

Alice is now the proud owner of 0.10 bitcoin, which she can spend. In the next chapter, we will look at her first purchase with bitcoin and examine the underlying transaction and propagation technologies in more detail.